Financial Highlights

(January 31,2017 Update)

TEPCO results for the fiscal year ended March 31, 2016 and forecasts for the fiscal year to March 31, 2017 are outlined here.

Major Financial Indicators

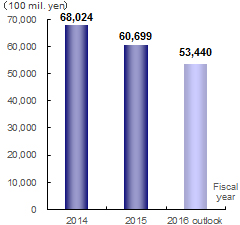

Operating Revenues

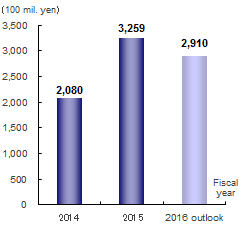

Ordinary Income

Net Income

Electricity Sales Volume

Summary of Revenues and Expenses*

| FY to Mar. 31, 2017 full-year forecast |

FY to Mar. 31, 2016 full-year result |

|

|---|---|---|

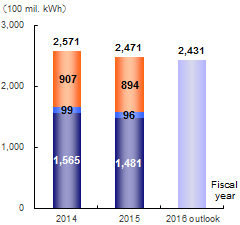

| Electricity sales(100 mil. kWh)* | 2,431 | 2,471 |

| Crude oil price(Japan nationwide CIF, USD/barrel) | Approx.47 | 48.7 |

| Exchange rate(Interbank, yen/dollar) | Approx.110 | 120.2 |

* Electricity sales of FY2015 : Tokyo Electric Power Company, FY2016 : TEPCO Energy Partner

FY2015 Financial Results (April 1, 2015 through March 31, 2016)

Tokyo Electric Power Holdings, Inc. (TEPCO Holdings) announced that Operating Revenues for FY 2015 decreased 10.8% from the same period of the previous fiscal year to 6,069.9 billion yen (down 11.1% to 5,896.9 billion yen on a non-consolidated basis). Ordinary Income increased 56.7% from the same period of the previous fiscal year to 325.9 billion yen (up 95.7% to 327.5 billion yen on a non-consolidated basis).

Electricity Sales decreased 3.9% over the same period of the previous fiscal year to 247.1 billion kWh, as a result of a decrease in Specified-Scale Demand and a decrease in heating demand due to higher temperatures during the winter.

Per demand type, Electricity Sales for Residential Usage decreased 1.4% to 89.4 billion kWh, those for Low-Voltage Usage decreased 2.7% to 9.6 billion kWh, and those for Specific-Scale Demand decreased 5.4% to 148.1 billion kWh, compared with the same period of the previous fiscal year.

On the revenue side, Electricity Sales Revenues decreased 12.8% from the same period of the previous fiscal year to 5,237.0 billion yen due to a decrease in the unit price of electricity resulting from fuel cost adjustments, among other factors. Operating Revenues, including electricity sales to other companies and inter-regional electricity sales, decreased 10.8% to 6,069.9 billion yen (down 11.1% to 5,896.9 billion yen on a non-consolidated basis). Ordinary Revenues decreased 10.4% to 6,141.0 billion yen (down 10.2% to 5,999.1 billion yen on a non-consolidated basis).

As for expenditures, in spite of cost increase factors including the suspension of all nuclear power stations and the depreciation of the yen, as a result of the extensive cost reduction efforts for all of TEPCO that continued from the previous year as well as largely decreased fuel costs due to the low price of crude oil, Ordinary Expenses decreased 12.5% for the same period of the previous fiscal year to 5,815.1 billion yen (down 12.9% to 5,671.6 billion yen on a non-consolidated basis).

Extraordinary Income totaled 773.0 billion yen (760.8 billion yen on a non-consolidated basis) including 699.7 billion yen in grants-in-aid from the Nuclear Damage Compensation and Decommissioning Facilitation Corporation and 61.0 billion yen in gain on revision of retirement benefit plan etc. Extraordinary Loss totaled 911.9 billion yen (911.5 billion yen on a non-consolidated basis) including 678.6 billion yen in Nuclear Damage Compensation costs and 233.3 billion yen in Impairment Loss with the aim of restructuring our business base so as to compete in challenging circumstances after deregulation of all the retail sectors and our transition to a holding company system.

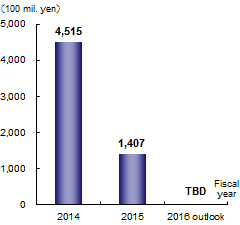

Net Income attributable to TEPCO Holdings shareholders decreased 68.8% from the same period of the previous fiscal year to 140.7 billion yen (down 66.4% to 143.6 billion yen on a non-consolidated basis)

We conducted succession of business on April 1, 2016. Fuel and thermal power generation business, general power transmission and distribution business, and retail electricity business were transferred to "TEPCO Fuel & Power, Incorporated", "TEPCO Power Grid, Incorporated" and "TEPCO Energy Partner, Incorporated" following method of company split. At the same time, we shifted to a holding company system, and changed our company name to "Tokyo Electric Power Company Holdings, Incorporated".

Summary of FY2016 Full-year Financial Forecasts

Operating revenues is around 5,344 billion yen due to a decrease in the unit price of electricity resulting from fuel cost adjustments.

Ordinary income is around 291 billion yen* due to the fall of fuel prices and the continued extensive cost reduction efforts on TEPCO Group level.

*Excluding Special Contribution (The amount of Special Contribution is determined following a decision by the Management Committee of Nuclear Damage Compensation and Decommissioning Facilitation Corporation based on the financial situation of TEPCO each fiscal year, and requires approval by the relevant Ministers.)